Maximize Your Self-Directed Brokerage Account

Professional investment management for BrokerageLink, PCRA, and other self-directed brokerage accounts within your employer's retirement plan.

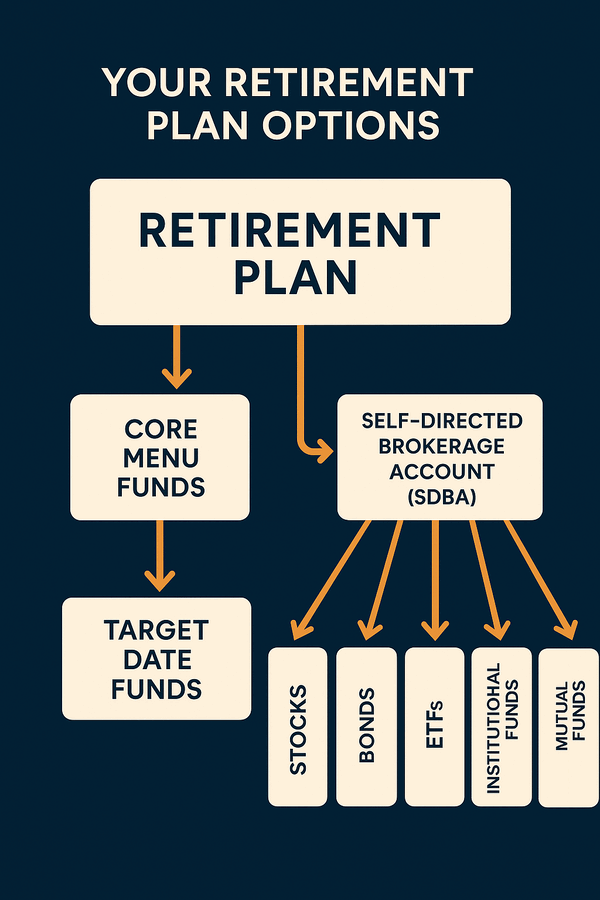

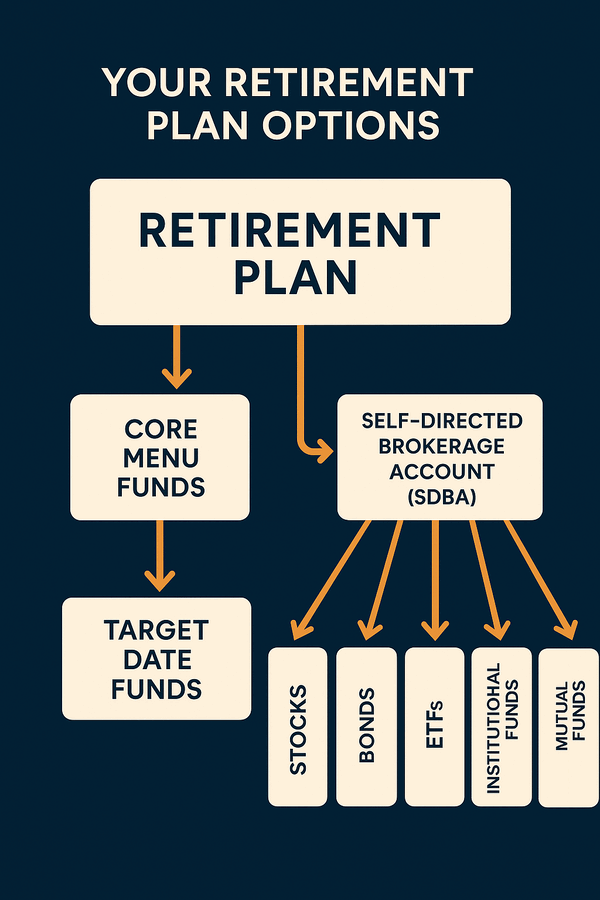

What is an SDBA?

A Self-Directed Brokerage Account (SDBA) is an option within your employer's 401(k) plan that gives you access to a broader range of investment choices beyond the standard fund lineup.

While your employer's default investment options might include 15-25 mutual funds, an SDBA typically provides access to thousands of stocks, bonds, ETFs, and mutual funds.

When you open an SDBA the money never leaves your 401k, it is just reallocated to a brokerage window. It is simply another investment option within your existing plan.

Is an SDBA Right for You?

SDBAs are ideal for investors who want more control over their retirement investments and are comfortable with a wider range of options—or who want professional guidance managing those options.

Why Choose a Professionally Managed SDBA?

Beyond just more options, it's about a smarter, more secure path to retirement.

True Investment Freedom

Break free from limited fund menus. Your SDBA gives you the power to invest in what truly aligns with your values and financial aspirations, from individual securities to specialized funds.

Confidence & Trust in Expertise

Don't navigate complex markets alone. Our advisors provide the expert guidance and personalized strategies you need to invest with confidence, building a portfolio you can trust.

Maximize Upside, Mitigate Risk

We actively seek opportunities for growth while implementing robust strategies to protect your capital. Our tailored approach aims to enhance returns and reduce volatility, far beyond what generic target-date funds can offer.

The Value of Professional Management

Leading financial research firms have quantified the value that professional advisors add to investment portfolios through strategic guidance, behavioral coaching, and systematic portfolio management.

Average Advisor Value Add

+3%

Estimated annual portfolio performance improvement with professional financial advice

Sources: Russell Investments, "Value of a Financial Advisor" (2023); Envestnet, "Capital Sigma: The Advisor Advantage" (2023); Vanguard, "Putting a value on your value: Quantifying Vanguard Advisor's Alpha" (2022). Methodologies vary—studies measure different service combinations and use different base-case scenarios.

Your Path to Investment Freedom

Three simple steps to break free from your 401(k)'s limited investment menu

Discover Your Options

Schedule a free consultation to learn if your employer's plan offers this powerful feature. We'll explain how you can access thousands of investment options while your money stays safely in your 401(k).

Design Your Strategy

Work with our advisors to build an investment strategy that matches your goals and risk tolerance. Finally, you're not limited to the handful of funds your employer picked for you.

Take Control

We handle all the paperwork and coordination with your plan administrator. Start investing in what you believe in—whether that's specific companies, sectors, or strategies unavailable in your current plan.

Our 100% Satisfaction Guarantee

We're confident in our SDBA management services. If at any time you're not satisfied with our service, we will help you reallocate your funds back to your plan's traditional menu options completely free of charge. No questions asked, no hidden fees. Your satisfaction and success are our top priorities.

Get Started TodayReady to Take Control of Your Retirement?

Whether you have Fidelity BrokerageLink or Schwab PCRA, our fiduciary advisors are here to help you make the most of your self-directed brokerage account. Schedule a free consultation to explore your options.

Frequently Asked Questions

Common questions about SDBA financial advisors

What is an SDBA account in a 401(k)?

An SDBA account (Self-Directed Brokerage Account) is an optional feature within your 401(k) plan that expands your investment choices beyond your employer's standard fund lineup. While typical 401(k) plans limit you to 15-30 pre-selected funds, an SDBA account gives you access to thousands of stocks, bonds, ETFs, and mutual funds.

The money never leaves your 401(k)—it's simply reallocated to a brokerage window within your existing plan. This means you maintain all the tax advantages of your retirement account while gaining significantly more investment flexibility.

Common SDBA platforms include Fidelity BrokerageLink and Schwab PCRA, though other providers like TD Ameritrade and Schwab also offer SDBA options.

What is a Schwab PCRA account and how does it work?

A Schwab PCRA account (Personal Choice Retirement Account) is Charles Schwab's version of a Self-Directed Brokerage Account (SDBA). It's a feature within your existing 401(k), 403(b), or other employer-sponsored retirement plan that allows you to move beyond the standard fund menu and invest in thousands of stocks, bonds, ETFs, and mutual funds—all while maintaining the tax advantages of your retirement plan.

The PCRA functions as a self-directed brokerage window within your existing retirement account. The money never leaves your 401(k)—it's simply reallocated to expand your investment options. You can invest in individual stocks, bonds, ETFs, and mutual funds—including institutional-class investments typically unavailable to retail investors.

Many investors work with a PCRA advisor to professionally manage their PCRA account and take full advantage of these expanded investment options. If your plan uses Charles Schwab as the custodian (even if you log into a different recordkeeper like Principal or Vanguard), you likely have access to a PCRA account.

How do I know if I have access to a PCRA account if I don't see Schwab branding?

This is where many people get confused: You might think you don't have a Schwab retirement plan because you log into a different website—like Principal, Empower, Vanguard, T. Rowe Price, or another provider. However, Charles Schwab may still be the custodian of your assets, which means you likely have access to a PCRA even if you've never seen Schwab branding.

Understanding the difference between custodian and recordkeeper:

- Recordkeeper: The company that administers your plan, maintains records, processes contributions, and provides the website you log into (examples: Principal, Empower, Vanguard, T. Rowe Price)

- Custodian: The financial institution that actually holds and safeguards your assets (example: Charles Schwab)

Many retirement plans use one company for recordkeeping and a different company for custody. You might log into "Principal.com" every day, but Charles Schwab could be holding your actual investments. If Schwab is your custodian, you may be able to access a PCRA through Schwab Workplace—even if you've never interacted with Schwab before.

How to check: Look at your most recent 401(k) statement for any mention of "Charles Schwab" or ask your HR department: "Who is the custodian for our retirement plan?"

Can I access a PCRA if my plan is with Vanguard, Empower, or Principal?

Possibly! Even though you log into Vanguard, Empower, Principal, or T. Rowe Price, Charles Schwab might be the custodian holding your assets behind the scenes. Many recordkeepers (the companies you interact with) use Charles Schwab as the custodian (the institution holding your investments).

If Schwab is your custodian, you can access a PCRA account through Schwab Workplace, separate from your recordkeeper's portal. Check your 401(k) statement or ask your HR benefits administrator: "Who is the custodian for our retirement plan?" If it's Schwab, you likely have PCRA access.

What should I look for in an SDBA advisor?

When choosing an SDBA advisor, look for these key qualifications:

- Fiduciary status: Ensures they're legally required to act in your best interest

- Specific SDBA experience: Understanding the unique features and restrictions of platforms like BrokerageLink and PCRA

- Direct platform access: Advisors who work directly with your SDBA platform (for example, Schwab PCRA) can provide more efficient service and may have access to institutional-class investments

- Transparent fee structure: Clear disclosure of all advisory and platform fees

- Investment philosophy: A disciplined approach to portfolio management, rebalancing, and risk management

What is a PCRA advisor and do I need one?

A PCRA advisor is a financial advisor who specializes in managing Schwab Personal Choice Retirement Accounts. With thousands of investment options available in a PCRA, professional management becomes valuable—especially if you have $100,000 or more in your account.

A qualified PCRA advisor provides expertise in portfolio construction, access to institutional-class investments, systematic rebalancing, and disciplined decision-making during market volatility.

What questions should I ask a potential PCRA advisor?

Before hiring a PCRA advisor, ask these critical questions:

- "Do you use a TAMP (Turnkey Asset Management Platform) to manage PCRA accounts?" – Many advisors use third-party platforms that add an extra layer of fees, often up to 0.4% annually. Advisors who manage accounts directly can avoid these additional costs

- "Are you a fiduciary?" – Ensures they're legally required to act in your best interest

- "What is your total fee structure?" – Get clarity on advisory fees, platform fees, and fund expenses

- "Do you have experience managing PCRA accounts?" – Specific platform expertise matters for navigating Schwab's system

- "Can you access institutional-class investments?" – Confirm they can provide lower-cost institutional fund classes

- "How often do you rebalance portfolios?" – Regular rebalancing is critical for maintaining your target asset allocation

- "How do you handle market volatility?" – Understanding their investment philosophy helps ensure alignment with your goals

Do I have to pay for SDBA management?

Yes, professional SDBA management requires an advisory fee. However, you will not receive a bill—all advisory fees are automatically deducted directly from your retirement account quarterly.

These fee transfers do not create taxable events. Unlike capital gains in a traditional brokerage account or early withdrawals from a 401(k), the fees paid for SDBA management do not trigger taxes or penalties. Your assets remain within the tax-advantaged structure of your retirement plan.

How is a PCRA account different from a regular 401(k)?

The two biggest differences are: (1) you can work with a financial advisor to professionally manage your 401(k), and (2) you gain access to thousands of investment options instead of the limited fund menu in your regular 401(k).

With a standard 401(k), you're on your own to pick from 15-30 funds your employer selected. With a PCRA account, you can hire a professional PCRA advisor to manage your retirement investments on your behalf—something that's typically not possible with regular 401(k) plans.

Additionally, a PCRA account unlocks access to:

- Individual stocks (U.S. and international)

- Thousands of ETFs covering every sector and strategy

- Over 10,000 mutual funds, including institutional-class options

- Corporate, municipal, and government bonds

- CDs and money market funds

This expanded choice requires more active management, which is why many investors work with a PCRA advisor to build a customized, professionally managed portfolio without the burden of daily management.

Should I use BrokerageLink or should I look for a Schwab PCRA account?

You don't get to choose—your employer determines which SDBA platform is available in your retirement plan. If you have Fidelity as your provider, you'll have BrokerageLink. If Charles Schwab is your custodian, you'll have access to a PCRA account.

Both BrokerageLink and Schwab PCRA accounts are excellent SDBA options that provide investment flexibility beyond your plan's limited fund menu. The key to success with either platform is working with a specialized SDBA advisor (or PCRA advisor for Schwab accounts) who can build a customized portfolio tailored to your goals, risk tolerance, and time horizon.

Should I manage my own SDBA account or hire an advisor?

It depends on your account balance, investment expertise, and available time. If you have $100,000 or more in your SDBA, working with an advisor often makes financial sense.

Consider professional management if:

- You have limited time to research investments and monitor your portfolio

- You want access to institutional-class investments with lower expense ratios

- You prefer disciplined, objective decision-making during market volatility

- You want systematic rebalancing and tax-efficient strategies

- You'd like your SDBA integrated with your broader financial plan

DIY management might work if: You have deep investment knowledge, enjoy portfolio management, can dedicate consistent time to monitoring and rebalancing, and can make disciplined decisions during market downturns.

Do I need an advisor if I have a Schwab PCRA account?

While you can manage a PCRA yourself, most investors with $100,000+ benefit significantly from professional management. A PCRA advisor provides:

- Institutional investment access: Lower-cost institutional fund classes that can save 0.20%-0.50% annually on expense ratios

- Professional management: Strategic portfolio construction, systematic rebalancing, and disciplined decision-making

- Time savings: No need to research thousands of investment options or monitor your portfolio daily

- Behavioral coaching: Objective guidance during market volatility to avoid emotional investment mistakes

When you combine the +3% advisor value-add from research with the cost savings from institutional investments, professional PCRA management often pays for itself while providing peace of mind.

What are the benefits of working with a Schwab PCRA advisor?

Working with a specialized Schwab PCRA advisor provides several key advantages:

- Institutional investment access: Lower expense ratios on institutional fund classes (typically 0.20%-0.50% lower than retail versions)

- Professional management: Expert portfolio construction, systematic rebalancing, and disciplined decision-making during market volatility

- Efficient execution: Experienced PCRA advisors can implement changes quickly and efficiently

- Platform expertise: Understanding of Schwab's unique features, investment options, and account structure

- Time savings: No need to research thousands of investments or manage your portfolio daily

- Behavioral coaching: Objective guidance to help you avoid emotional investment decisions during market downturns

Research shows advisors add approximately +3% annually through professional management, often far exceeding the cost of advisory fees.